Managing cash flow for a not-for-profit

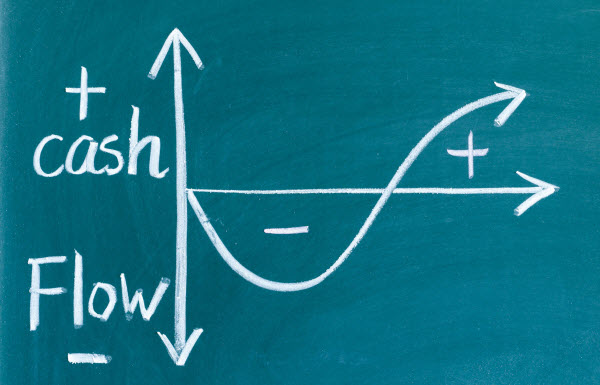

Managing cash flow in any business is a tricky balance to maintain. In a not-for-profit environment, different factors, compliance and regulation requirements influence the cash flow balance.

Meticulous financial planning and adequate forecasting are necessary to ensure cash shortages don’t diminish the great works you’re doing through your initiative.

The why and when of managing cash flow

Let’s unpack why it is important to manage cash flow, when it’s most important and how to plan your cash flow.

The ‘why’ of managing cash flow

The cash flow balance is at its most vulnerable when the timing of grant payments or donations doesn’t align with when monthly payments are due. According to Propel Nonprofits, factors that negatively affect cash flow include:

- In-arrears contract payments

- Advanced payment timing obligations

- Changes in revenue sources or payment schedules

- When expenses exceed revenue (operating with a deficit)

- Unexpected or unplanned events or expenses.

We have clients with real-life examples of some of these:

- A milestone-based contract that only releases grant payments after the completion of a (substantial) project milestone, forcing the NFP to cashflow the project’s operations up-front for six months

- NFP needs to pay venue hire deposits and marketing costs for an event some months in the future, with income for the event only expected in the weeks immediately prior.

The negative knock-on effect these factors may have can be significant to the future of an NFP organisation. Incurring penalty fees or finance charges not only puts pressure on your cash flow but could sour relationships with suppliers and mean that important future mission-building opportunities could be lost. The biggest risk of course is that of insolvency – an inability to meet your debts as they fall due. Trading while insolvent is against the law and can result in jail time for directors. So when cash is tight, it is essential to actively manage cash flow and understand what the coming months look like so that you can take action to avoid insolvency.

When is it most important to manage cash flow?

The short answer is always, but there are times when paying more focused attention to your cash flow is necessary. New program development or a change in sources and funding structures will require a dedicated cash flow focus.

If a not-for-profit is recovering from or facing future debt or is making changes to staff or program resources, managing cash flow needs particular attention.

Adopting successful cash flow management strategies

When reporting on cash flow for a not-for-profit, it is crucial to explain the detail in your financial statements. Although the standard accounting reports highlight things like budget, income and business transactions, they don’t necessarily reflect the current cash flow balance. Financial automation tools can be a strategic game changer.

Not-for-profits rely on grants and donations, and fundraising activities may generate cash income. This income is often intermittent, and the amounts can vary.

It is vital to plan your cash flow and regularly manage its performance. More than ensuring enough funds in the bank, effective planning makes the difference when planning community programs, increasing resources or simply paying operating or maintenance costs like heating or replacing a carpet.

Plan, plan, plan

We cannot stress the importance of cash flow planning enough. Aim for a 12-month forecast that details opening cash balances, pragmatic budget allocations, detailed annual repayment plans, conservative income or grant payments (the surplus will be a pleasant surprise, too) and payroll expectations.

You can use your annual budget as the starting point, removing any ‘non-cash’ items such as depreciation, changing the timing of income to reflect when the cash actually arrives and making sure to add in at the appropriate time the big cash payments out for BAS/IAS and superannuation.

Here’s a quick reference checklist from Propel Nonprofits that may help:

- Start with an accurate cash balance

- Set realistic budget projections

- Check the timing of receipts and payments and make a note

- Use conservative assumptions for grant payments

- Check whether grants stipulate when they are to be used, and don’t include them in your forecast if restricted by timeframes

- Check your payroll schedule and consider whether it’s monthly or fortnightly

- Note any lump sum payments like insurance or taxes.

Statement of cash flow

Jitasa Group defines the statement of cash flow as a summary of money coming into and going out of the organisation over a specific period of time. Statements of cash flow are prepared at regular intervals (usually monthly and at financial year end) to show the sources (where the cash comes from) and uses (where cash was spent) of cash for a given period.

The Australian Accounting Standards Board’s 107 amended Statement of Cash Flows incorporates the IAS7 Statement of Cash Flow issued and amended by the International Accounting Standards Board (IASB).

Per the Statement of Cash Flow, these costs are divided into three categories:

- Cash flow from operating expenses like contracts, employees and contributions

- Cash flow from investing activities like equipment or vehicle purchases

- Cash flow from financing activities like credit card and loan payments.

At AFG, we work with our clients to create a cash flow framework and recommend areas to help optimise cash flow balances through income and payment strategies.

Contact one of our expert team members today to explore how we can help manage your not-for-profit cash flow.