Unpacking the AASB for Not for Profits

The Australian Accounting Standards Board (AASB) governs Australia’s accounting standards. It stipulates the requirements that all Australian entities must meet. The AASB aims to develop and maintain a consistent and quality set of accounting and reporting rules.

The AASB is a Commonwealth entity under the Australian Securities and Investments Commission Act 2001. There are currently 58 AASB standards, 12 amending pronouncements that are not yet fully compiled and 14 pronouncements that are fully compiled. We unpack some AASB rules and highlight the most important ones for not-for-profit organisations.

AASB 1058 and AASB 15

Although multiple other AASB standards affect NFP accounting treatment, the two most significant are the AASB 1058 and AASB 15, which deal with revenue.

AASB 1058

Some NFP income streams differ from for-profit revenue sources. AASB 1058 exists to specifically address accounting requirements for these other sources of income for Australian NFP organisations. The objective of AASB 1058, entitled Income of Not-for-Profit Entities, is to establish principles for not-for-profit entities that apply to:

(a) transactions where the consideration to acquire an asset is significantly less than fair value principally to enable a not-for-profit entity to further its objectives; and

(b) the receipt of volunteer services.

In addition, if the consideration provided to acquire an asset, including cash, is significantly less than the fair value of that asset, or if no consideration was provided, and the difference is principally to enable the entity to further its objectives, such a transaction is within the scope of this Standard. For example, an entity that receives a cash grant to be used to further its objectives might not have provided any consideration in exchange for that cash. As another example, governments are entitled to non-contractual receivables arising from statutory requirements such as taxes and rates without considering the other party. Those receivables provide income to the government to further its objectives. The AASB 1058 standard addresses the accounting for the income arising from such transactions.

The AASB 15

The AASB 15 deals with the commercial revenue of for-profit organisations. In Australia, the IASB Standard has been amended to include an appendix that aims to explain and illustrate the AASB 15 specifically for NFP entities.

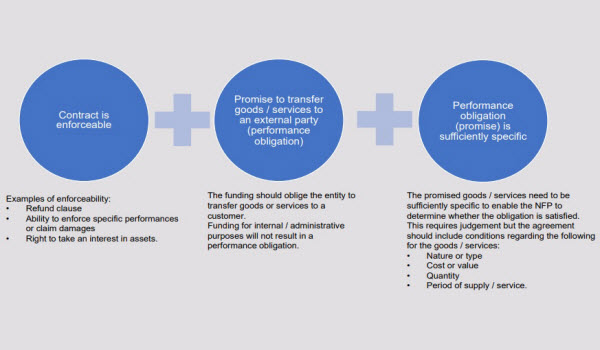

This diagram (created by the team at the AASB) explains when contracts or agreements fall within the scope of the AASB 15. They also provide the following explanation:

Once the performance obligations (promises) in the agreement are identified, an NFP entity identifies how and when control of the performance obligation is passed to the customer and recognises the revenue accordingly, for example:

- If control is passed at a point in time, for example, when goods are transferred to the customer, then the revenue is recognised at that particular point in time.

- If control is passed continuously through the service period, for example, provision of a service regularly over the life of the contract, then the revenue is recognised on a straight-line basis as the service is performed.

The main difference between the AASB 1058 and AASB 15

CPA Australia says the difference between the two standards is that the AASB 15 changes revenue recognition from the “transfer of risks and rewards” model to a “transfer of control” model.

AASB 1058 intends to reflect the economic reality of the underlying transaction more closely and replaces the vast majority of AASB 1004 contributions.

To put that into plainer language, AASB 15 deals with revenue where there is an enforceable contract and ‘sufficiently specific’ performance obligations, and if those conditions are not met, then AASB 1058 will apply.

How other AASB standards differ in NFP accounting reporting

It is worth noting that when an NFP entity holds a for-profit subsidiary, different accounting treatments per the Australian Accounting Standards apply, which may be impacted. We have defined the categories, allocated the relevant accounting standard and listed the NFP difference per the Australian Accounting Standard not-for-profit entity requirements. A more detailed definition is listed in the document provided by the AASB.

| Accounting category | Relevant Australian Accounting Standard | The NFP difference |

| Valuation of non-current assets | AASB 1 (First-time Adoption of Australian Equivalents to International Financial Reporting Standards) AASB 116 (Property Plant and Equipment) AASB 136 (Impairment of Assets) AASB 138 (Intangible Assets) |

Revaluation increments and decrements offset by a class of assets as opposed to an individual asset. |

| Cash generating units | AASB 136 (Impairment of Assets) | The same treatment applies to for-profit entities and to NFP entities when future cash flows are expected to be derived from an asset or cash-generating unit (CGU). space When the future economic benefits of the assets are not primarily dependent on the asset’s ability to generate net cash inflows, and when the entity would, if deprived of the asset, replace its remaining future economic benefits, the value in use is depreciated replacement cost of an asset. |

| Grants | AASB 120 (Accounting for Government Grants and Disclosure of Government Assistance) AASB 1004 (Contributions) AASB 141 (Agriculture Consequentially affected Standards) AASB 112 (Income Taxes) AASB 123 (Borrowing Costs) AASB 138 (Intangible Assets) |

Apply AASB 1004 Contributions (whereas for-profit entities should apply AASB 120). |

| Assets received at no or nominal cost | AASB 102 (Inventories) AASB 116 (Property, Plant and Equipment) AASB 138 (Intangible Assets) AASB 140 (Investment Property) |

All inventories, property, plant and equipment, intangible assets and investment property received at no cost or nominal cost are initially recognised at fair value at the date of acquisition. |

| Inventories held for distribution | AASB 102 (Inventories) | Not-for-profit inventories are subsequently measured at cost, adjusted when applicable for any loss of service potential as opposed to the lower cost and net realisable value required by for-profit businesses. |

| Disclosure | AASB 1049 (Whole of Government and General Government Sector Financial Reporting) AASB 102 (Inventories) AASB 116 (Property, Plant and Equipment) AASB 138 (Intangible Assets) |

Disclosure requirements in relation to the whole of government and general government sector (GGS) financial reporting are set out in AASB 1049. space Other disclosure requirements have been clearly highlighted in space AASB 102.36 and AASB 102.Aus36.1 AASB 116.Aus77.1 and AASB 138.Aus124.1 |

AASB 107

When managing cash flow in a not-for-profit, organisations must comply with the amended AASB 107 Statement of Cash Flows in their external reporting. This standard focuses on three categories of cash flow:

- Cash flow from operating expenses like contracts, employees and contributions

- Cash flow from investing activities like equipment or vehicle purchases

- Cash flow from financing activities like credit card and loan payments.

When AASB standards change

As we mentioned, there are currently 12 amending pronouncements that have not yet been fully compiled and 14 pronouncements that have been fully compiled. Once these standards have been cumulated and approved, they are shared with Australia’s business community.

Changes will often require that existing accounting processes be adapted and reporting calculations changed. Your NFP board will also require an update on when the AASB announces changes and how these changes impact your financial reporting.

AFG’s senior team members are fluent in the AASB standards. Talking about the changes to the AASB 16 in 2020, and just as relevant in this case, True Accounting Account Manager Jane Chen says, “Different auditors have different perspectives on the complexities surrounding the AASB standards. When amendments are made to the AASB standards, we work with the auditors as much as possible to avoid any surprise changes at audit time.”

AFG understands the AASB and is a not-for-profit accounting specialist, so can offer advice and recommendations regarding NFP financial reporting. Contact us for help with the Australian Accounting Standards and how these standards could affect your organisation.

Read more not for profit accounting articles.